Ramblings on Blockspace

An overview of the creation, usage, value, and trading of the new digital commodity: blockspace

Everything written in the post is outlined in the following repository github.com/0xperp/awesome-blockspace

The ability to transact, store data and perform compute on a blockchain is what comprises blockspace. Intuitively the transactions that are included in a block are the blockspace.

Increasingly in various articles, posts, and podcasts blockspace is referred to as the “best product to be selling” or the “most important commodity” to be selling in the 2020s. Understanding what blockspace is, how it is created and valued can be quite confusing and is constantly evolving.

All blockspace is not created equal and actually varies quite a bit. Blockspace is a class of commodities that can be easily graded on common characteristics like security, flexibility, and decentralization. This piece will detail each characteristic and provide some examples then explore the market participants for one of the most valuable digital commodities that exists.

First a quick aside on consensus mechanisms that secure blockspace

Proof of work (PoW) requires miners to solve complex mathematical problems in order to validate transactions and create new blocks. The first miner to solve the problem is then rewarded with newly minted tokens. The process of solving these problems requires a large amount of computational power, making it difficult for any one miner to control more than 50% of the network's computing power. If a miner were to control more than 50%, they would be able to launch a 51% attack. In a 51% attack, the miner with the majority computing power can manipulate transactions and even reverse them, potentially allowing them to double spend coins. Today almost all of PoW production occurs through a mining pool.

Proof of stake (PoS) is a newer consensus mechanism that requires users, known as validators, to put up a certain amount of cryptocurrency as collateral in order to validate transactions and create new blocks. Validators are chosen based on the amount of tokens they have staked, and are incentivized to act in the best interest of the network.**

Qualities

Blockspace can be built and produced in many different ways along with being consumed for a multitude of different purposes. Every blockspace market has varying levels of security, decentralization, and guarantees along with different choices in the size, amount, and how the blockspace is verified. When deciding to be participant in the blockspace economy there are a few different qualities that you might want to evaluate.

Security

Perhaps the most important quality is the security of the blockchain. How hard and how many resources are needed to attack the chain. Commonly this is known as a "51% attack" but there are other types of consensus mechanisms that only require 33% of producers to agree.

A common metric for measuring a blockchain's security is by looking at the "cost to attack". In order to control 51% of the network how much does it cost to rent and/or purchase the hashpower/stakeweight. You can find (extremely) rough estimates on sites like crypto51.

Full blown take over of a blockchain is quite rare and has only happened a few times one being the Justin Sun’s takeover of the steem blockchain. Often I think about why blockchains such as Dash, BitcoinSV, or even more well known blockchains like Zcash have not seen more regular full takeovers yet, but if they have such poor security its not hard to reason that their other qualities are just as or even worse.

A far more common attack is a simple reorg of a blockchain. This is seen quite often in blockchains like Polygon which reorgs quite often. It is important to note that re-orgs on Polygon aren’t always malicious given Polygon’s probabilistic consensus however a reorg can also be an attack in which block producers reorganize transactions from prior blocks for their benefit.

To better understand the problems with reorganization consider the following example of a small business bidding on advertising space on a billboard on a popular highway. The business owner finishes a bidding war with their competitor paying 20% more than they initially wanted. Happy with the billboard they send their designs to the billboard company. A few weeks later the small business owner takes a drive to the highway to see his advertisement only to find that their competitor is on the billboard. This is similar to what happens in a reorg, transactions that you previously paid for are “rolled back” and re organized.

Security is likely the most important characteristic for a consumer of blockspace, they want to ensure transactions that they pay for are secure and relatively immutable. This directly impacts the value of the blockspace, the producer’s willingness to spend resources to produce the blockspace, and eventually the traders appetite to trade it.

Decentralization

A close runner-up to the security of the blockchain is the decentralization of it. Decentralization has a few equally as important parts

Nakamoto Coefficient

Distinct Operators

Geographic Distribution

Client Diversity

Unique Hardware

github.com/theSamPadilla/blockchain-infra-decentralization-metrics is a really nice repository that classifies blockchain decentralization based on

Stake distribution across infrastructure providers.

Stake distribution across geographies.

Validator distribution across infrastructure providers.

Validator distribution across geographies.

The Nakamoto Coefficient is by far the most common metric for measuring a blockchains decentralization. It is a very simple formula # of validators or % of hashrate needed for attack and is helpful in understanding the number of validators that would have to collude together to successfully slow down or block any respective blockchain from functioning properly.

Equally as important as the number of actors is the number of distinct actors that are needed for collusion. For example Coinbase operates about 7% of validators on Ethereum. Lido, a liquid staking provider, currently makes up ~33% of the validators on the Ethereum Network. Lido does not run validators themselves, instead they work with trusted operators in the space like Coinbase. When counting their base share plus the number of validators that they operate on behalf of Lido, Coinbase actually makes up ~12% of the entire network.

https://dune.com/queries/2394100/3928083

Bitcoin is generally regarded as a leader in decentralization although only has a nakamoto coefficient of around 5. While it is true that there are many unique and district mining operations Bitcoin mining pools have full and complete control over the ordering of transactions in a block (until Stratrum V2 is fully implemented and used).

For the majority of Bitcoin's lifetime 1 or 2 pools control over 33% of all the hashrate and thus the ordering of the transactions in a given block.

https://mempool.space/graphs/mining/pools

Some market participants care greatly about how their transactions are ordered in a particular block and having the transactions entirely ordered by a single party greatly degrades the quality of the blockspace for them. Note that this is the same for rollups that have a single sequencer.

Having a single party order/build the majority of the blockspace intuitively is a poor for decentralization but also can have significant ramifications with regards to producers extracting additional value for themselves. Commonly known as maximum extractable value (MEV), producers can extract large amount of value. It is also important to note that MEV is helpful for certain applications to function well liquidations (remember “black thursday” when liquidators failed to show up?) , arbitraging to keep markets competitive, and even searchers being needed for squeeth rebalances are all good examples.

MEV is a very large and important concept (the MEV supply chain is now it’s own multi-billion dollar industry) to understand when discussing blockspace it likely warrants it’s own piece. Instead here are a few points to know

It is important to build a separate MEV supply chain as to not harm blockspace consumers. There are many protocols working on solving this

Suave from Flashbots

Jito for Solana

Skip for Comsos

Stratum V2 for Bitcoin

(still waiting on Polkadot and Near based MEV solutions)

MEV exists in Bitcoin to and large mining pools have started to extract it

The amount of MEV that can be extracted is a direct correlation with how valuable the given blockspace is

Size, Amount, Validation

The actual specifications of the blockspace are also import factors to consider when judging the quality. These are very simple and well defined

How large are the blocks? How many transactions can fit in a single block? How much data can you fit in a block?

How often are blocks produced? How many blocks are produced in a day?

How does the network come to consensus on the blocks?

Questions around the size and the amount of blockspace are generally qualities that consumers or traders need to consider. If a consumer is looking to complete a transaction in an hour how many total blocks are there to bid for a transactions space on and as a trader how scarce is the blockspace.

Evaluating how the network comes to consensus on a block is likely a quality that an institutional consumer would care about. This could be a fund or trading firm, but more likely an application built on top of the given blockspace like an exchange, custodian, or L2. An exchange would likely assess how a network forms its consensus because it can impact the execution for their users. Some examples of how various network actors form consensus

Round Robin / Leader Election

In a round robin validators are periodically selected to build, propose, and include the entire block themselves.

Examples of this include Solana, Cosmos, and Polygon

General Consensus

In a general consensus network a producers broadcasts their block to the rest of the network and if agreed on the block is included.

Examples of this include Bitcoin

Single Sequencer

A majority of layer 2 networks implement a single sequencer who orders all transactions, forms them into blocks, and publishes them to the layer 1 or data availability layer

Examples of this include Arbitrum and Optimism

Note: that the building of the blocks is often abstracted into its own auction like mechanism or even eventually abstracted to its own chain like SAUVE. Read here for a really good look at block production

How consensus is come to effects the execution of the exchange in question a little differently.

The round robin leader election is often very fast but for networks that have not abstracted the block building layer, exchange participants that are also validators have the upper hand. For a more detailed example see the DyDx example in this AMMs and Orderbooks piece.

The general consensus is the most fair for the execution the exchanges user's but currently struggles with handling high throughput. As of 2023 a well functioning and fast orderbook has yet to really be seen on a blockchain that uses a general consensus. In fact DyDx highlighted this in their blog post when they moved from Ethereum mainnet to Starkware.

A single sequencer is very fast but also very centralized and an exchange building on a network that currently uses a centralized sequencer needs to be okay with the possibility that the sequencer operator is frontrunning or extracting some type of value from their user's orders.

A fourth option for the exchange would be to operate some parts of their infrastructure offchain, like their orderbook. This is again highlighted in AMMs and Orderbooks under the hybrid section.

Note: many protocol teams are now also exploring operating their own appchain, this has the benefits of speed, scalability, and the centralized sequencer being operated by the protocol team although suffers from the need of bootstrapping your own validator set and likely having far less security. More on this in the flexibility quality.

Availability

Ensuring that access to consuming, accessing, and producing blockspace is widely available and can always be consumed can be an extremely important quality.

Are you able to easily access the blockspace? Is it always available or are their chain halts or downtime? How easy is it to run your own RPC node or access publicly available ones? Are RPCs generally overloaded, do they have consistent uptime?

Uptime

As a consumer it is very important that you can you access blockspace market at any time. If a blockchain has frequent halts or outages you can not reliably use the blockchain.

Take the example that you are a new liquidity provider who want to provide liquidity to a concentrated liquidity AMM and you are choosing between the Solana and Ethereum blockchain. Solely evaluating the characteristic of uptime the choice is easy, Solana and seemingly every L2 has seen several day long outages in the past year in which the entire chain is unusable.

Chain State and Storage

As a producer (and maybe as a consumer) considering how accessible it is to download, verify, and store the full chain state can be an important consideration.

As a blockspace producer you want to ensure that you have extremely high uptime and little dependence on others in case they have an outage. Some blockchains like Solana or Near effectively require you to download chaindata snapshots from AWS S3, Google BigTable, or other validators with often little to no way to sync and store the chain data entirely yourself.

Chain state and storage is also an upmost consideration for applications or protocols that require historical data. On Bitcoin or Ethereum it is possible to fully sync a node in a few days and have a full set of historical data. On the other hand Solana's full chain state is primarily stored in a Google BigTable database and takes up petabytes of data, rendering it next to impossible for any average consumer to sync and store.

Note: there are some significant engineering challenges in storing historical solana data but plenty of great teams working on it. One such example is the Triton One team building Old Faithful

Costs and Fees

Blockspace is valuable and has various costs and fees associated with producing and consuming it.

As a producer there are more traditional costs such as the upfront purchase and/or ongoing costs of various hardware and software that allows you to operate on the network. More often than not there is also the initial capital outlay for tokens that need to be posted as collateral to validate (as is the case in Proof of Stake networks). In turn you generally receive block rewards from the network which could also include fees generated from consumers of the blockspace you produced.

As a consumer in order to utilize blockspace on a given network you need to pay a fee for it to the block producers (this does not count additional fees you might need to pay a protocol for your interaction).

Costs and fees vary depending on the blockchain's implementation and also how the fee market is designed. Generally a chain implements one of the following designs

Priority Gas Auctions (PGA)

Consumers who what to utilize blockspace will submit their transaction with a given fee, the transaction sits in the mempool. Since the producer accrues the fees in the block they (generally) order the transactions in by highest fee.

This is a very simple fee market design and is the most common.

EIP 1559

Consumers who want to utilize blockspace will pay a base fee (which is burned) and a priority fee (or tip) which the block producers. Introduced for better consistency in estimated fees needed to be paid by a consumer.

This has primarily been implemented on Ethereum but prior was implemented on Filecoin

The design of the fee market heavily influences the amount and potential willingness of a consumer to pay and how much the producer is expected to receive for their block production.

The research space for fee market design is quite interesting and extensive and I have complied an awesome list at github.com/0xperp/awesome-fee-markets.

Flexibility

Blockspace can be highly adaptable or very static. The majority of the time consumers likely prefer the space that they are consuming to be very predictable and static, but there are certain use cases in which a consumer (often a protocol) might want their space to be highly adaptable and flexible.

Flexible blockspace is the idea that blocks can be built differently according to various use cases. Maybe this is adding pre and post instructions at the validator level, allowing blocksize to fluctuate or being able to abstract block building.

Take the example that you are a lending and borrowing protocol that has started exploring launching their own blockchain. They have a few options to consider launching

Cosmos based Appchain

Rollup based on the Optimism or Arbitrum stack

Parachain on Polkadot

Subnet on Avalanche

Each one of these has different considerations in security, decentralization, and usage.

A Cosmos Appchain requires you to bootstrap your own security by incentivizing a validator set but allows you to have extreme flexibility in your consensus, block building and execution of transactions (especially by adding custom logic using functions like

BeginBlockorEndBlockas referenced here)Building a rollup with the Optimism stack (currently) limits you to being centralized being able to only operate a single sequencer, but allows you to have create extremely fast, EVM compatible blockspace

A Polkadot parachain allows for you to use the Polkadot shared security model but requires you to bid quite a lot of DOT in the auction in order to be included.

In brief

A Cosmos Appchain has the ultimate flexibility in blockspace creation, control, and security

A Rollup provides flexible blockspace creation, but control and security is limited to a single and centralized sequencer currently

A Parachain bootstraps security from the Polkadot mainchain… except you have to bid for it

Note: joncharbonneau.substack.com/p/rollups-arent-real is a really good read dissecting the current state of rollups

Bitcoin, Ethereum, Polkadot, etc. all produce generalized blockspace. Osmosis, Aevo, Lyra, Sentential are use customized and specific blockspace to improve their products.

In the recent months it has become even easier to launch a OpStack, Arbitrum, or other rollup / appchain with products like Caldera and Conduit.

Market Participants

The blockspace market is extremely complex but can be broadly broken into producers and consumers.

Producers

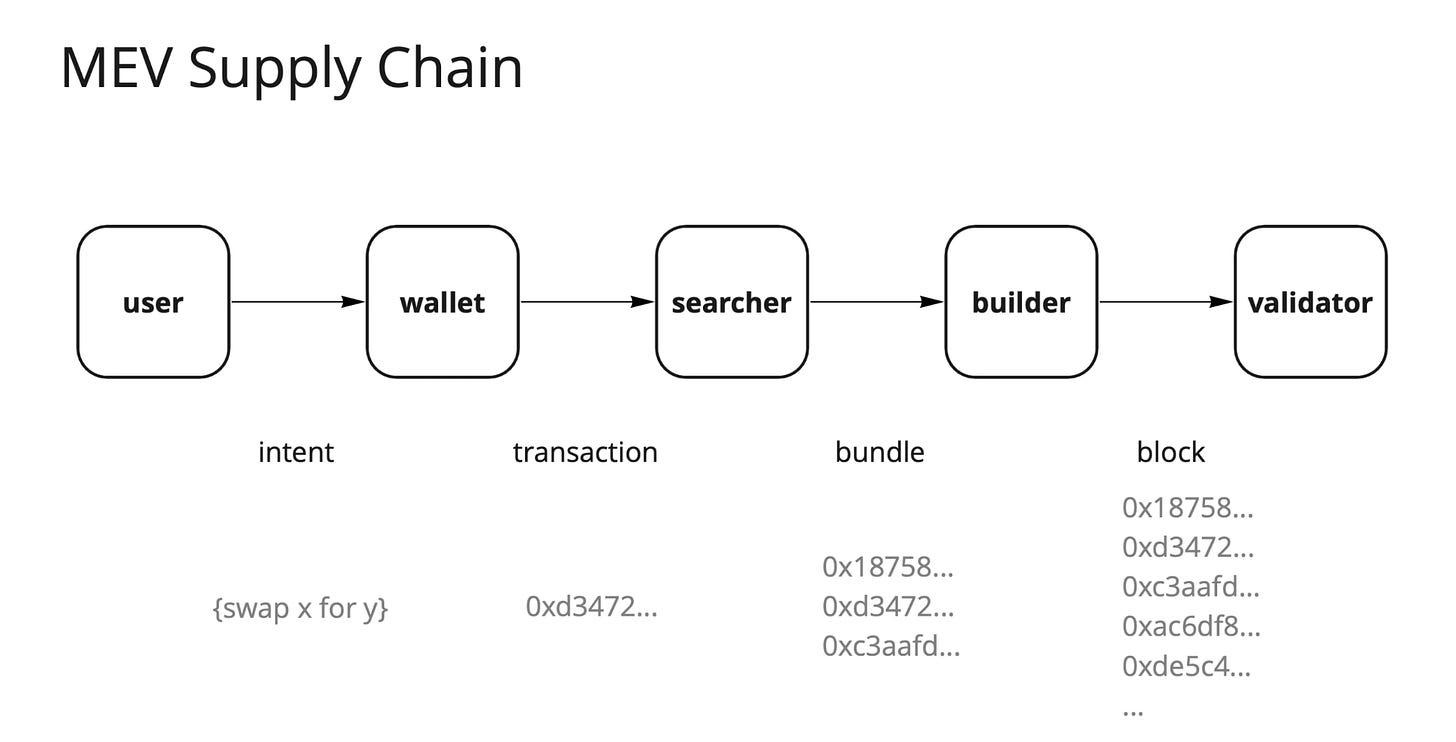

A Blockspace producer is a network participant that takes a set of transactions waiting to be be included and actually builds them into a block by ordering them. Often this is one of the roles of a validator, miner, or mining pool on a given chain. With the rise of MEV protocols this block building has largely been outsourced to separate actors known as builders. The “MEV supply chain” is now quite complex and involves many distinct actors as illustrated below

https://writings.flashbots.net/mev-supply-chain/

On the proof of work side mining pools have full autonomy over the ordering of transactions in blocks that are mined by miners in their pool. With the release and adoption of stratum v2 this will change and allow individual miners to express transaction ordering preferences to mining pools.

Producers want to produce blockspace that is highly valuable or has some expectation to be in the future. Below is a list of some companies that are large producers across a variety of blockchains

Coinbase Cloud (via Bison Trails acquisition)

Jump Crypto (via Certus One acquisition)

Consumers

A consumer is any entity that uses blockspace that is being produced. The actual usage can be for a large variety of things like transfers, swaps/trades, other financial transactions, etc.

However the largest consumers can often be overlooked. Often asset issuers, exchanges, and protocols built on top of the blockchain are some of the largest consumers. Below is a list of some protocols / companies that are large consumers

Arbitrum, Optimism, other L2s (increasingly in a environment in which many app teams are deploying their own rollup)

and of course power users / traders

Valuing

Blockspace can vary extremely in terms of its demand. Data Always had a really good overview of 2022 in blockspace demand. Below is a chart of blockspace fees across leading protocols

It is worth noting that a large percentage of the fees paid at native protocol block subsidies. Something valuable to watch in terms of real demand and growth is the percentage that user transactions fees make of the total block reward. For example on Bitcoin this averages around 2-4% but over on Ethereum it is similar in times of low activity but can spike to 60%+. When tracking a protocol with a developed MEV supply chain, tips should also be included.

A few chains have spent time developing unique fee markets one being Ethereum with EIP1559. This upgrade had a few goals such as lower fee volatility but also had an important long term goal of preventing instability of a blockchain in a world were there is no continued native issuance. 1559 lead to base fee burning and priority fees going to validators working towards placing less emphasis/importance on the role of the block subsidy in the overall block reward.

In order to keep up with its promise of cheap fees Solana created localized fee markets in which the transaction fee is localized to each distinct contract interaction. If there is a high demand NFT mint on Magic Eden transaction fees will not increase on Jupiter. This change is very consumer focused as it actually reduces the fees that a validator could expect to earn. However given Solana has a built out MEV supply chain, localized fees might bring in more users and thus more fees via MEV tips.

Valuing blockspace is still in it’s extremely early stages and with a majority of a block reward on a given chain is via the predictable block subsidy there is not much variability in the rewards and corresponding valuation. However as transaction fees/tips become a increasingly larger percentage of the overall block reward via halvings, increased demand, creation of MEV supply chains, etc. valuations become more unpredictable and introduce unique trading opportunities.

Trading

Blockspace is notoriously mispriced. In many cases the blockchain misprices how it pays its producers, as they continue to print more inflation for terrible quality blockspace. A majority of blockspace is cheap and abundant with very few being valuable.

This is were I look forward to newer implementations of block rewards and fee markets. Currently most blockchains put out a whitepaper with static block subsidies that are maybe on some disinflationary schedule. How can they be sure they are pricing their blockspace accurately before their blockchain is even live? I am looking forward to new implementations in determining block subsidies.

Given how new these markets are you likely have only ever been a producer or consumer and have not even considered that you could trade blockspace. Right now these trades are usually expressed through swap, forwards, and futures but there have also been more unique instruments like royalties, block inclusion reservation, and gas tokens.

Some of the primary places to trade blockspace currently are

Luxor where you can trade non-deliverable forwards on Bitcoin “Hashprice”

Alkimiya a much more flexible swap marketplace where you are able to trade swaps on Bitcoin and Ethereum blockspace along with potentially gas swaps

A few projects with a lot of potential

Overlay a perpetual future platform that allows you to trade native data feeds and specifically mentions various blockspace components in their documentation

Oiler which has a variety of products but one being Pitchlake in which you can trade base fees on Ethereum

Volmex a volatility trading platform that I could see eventually launching something like fee or validator reward volatility indexes

A product that is interesting to reason about is forming an index on blockspace quality based on the characteristics above and forming a blockspace swap market across blockchains something like a swap between Bitcoin and Ethereum’s blockspace demand

Outside of speculation markets that Luxor, Alkimiya, and others are building are extremely important in creating markets for risk transfer between blockspace producers and those that are willing to take on the exposure. As public companies and energy companies enter the Bitcoin production space they will want to decrease volatility in their cashflow. As L2s become more sophisticated they will want to hedge their transaction expense on L1s. As exchanges and asset issuers look to operate more efficiently hedging their variable transaction cost becomes important.

Overall the introduction of more robust capital markets around blockspace consumption and production is something I am extremely excited for and interested to see how it develops.