10 things I would do if I lead strategy/product at Polymarket

$POLY, indexes, and more instruments

Below is a list of 10 things that I think would be worth the Polymarket team's time to think about and potentially implement over the next 2-3 years.

In a broad summary

Launch $POLY to cut down on market maker incentives and own your own dispute resolution

Turn on the fee switch!

Add yield to your collateral

Build a scalable parlay system

Launch an Index Business

Have an OTC / Pro Trading Interface

Look more like a news platform

Incorporate other instruments like dated futures and perps

Expand your user created markets

Launch private company valuation markets

Launch $POLY

The high level here is use it to replace the USDC market-maker incentives and replace UMA with your own dispute resolution.

You guys spent ~$6m in USDC incentives that can/should just be some token inflationary rewards.

For example Aevo (who has slightly smaller but similar exchange volume to Polymarket post election) is distributing 100k Aevo per week to stakers (~0.52% of their token supply per year). Pulling their average token price over the last year thats about ~$4m in incentives that they have paid stakers, so assuming a similar token price (which in my opinion is extremely conservative) you’d be paying out ~0.76% of your token supply per year in incentives (not bad!). The obvious difference here of course is that Aevo has a vote escrowed staking model and this would be for paying market-making incentives but paying out <1% a year in token inflation is significantly better than paying $6m in USDC. Also given your last funding round the % amount you’d be paying here would be significantly less since Aevo is only worth $150m fully diluted and your last round was $350m.

The second reason, and more important is, replacing UMA dispute resolution with your own process. Potentially this could be as simple as forking / using the UMA protocol but with $POLY. The benefits of simply forking are clear (1) you own the dispute process (2) your token will likely have far better distribution than $UMA (3) if traders have problems with the dispute process they can purchase $POLY and play a role in the process and that directly accrues to your protocol rather than UMA.

Alternatively you could try out new types of dispute resolution. As Michael pointed out this could take the form of using platforms that have multiple layers, he suggests the following

One example is @Truemarketsorg model, which combines council voting, token-holder governance, and attester validation. Other potential solutions like @opinionlabsxyz include reputation-based voting and randomly selected juries with equal voting power, both of which could mitigate controversies and improve market integrity.

Note Michael also has a great post on the future of prediction markets, check it out!

I have also thought that adopting something like peer prediction as described in the old Upshot One whitepaper would be super interesting. Here’s their abstract

Reaching consensus on answers to subjective questions is, today, practically achievable via trusted sources or expensive mechanisms. This greatly limits the potential of many applications (e.g. dapps, content moderation, insurance, fact-checking). We propose a protocol for solving this problem that combines cryptographic sortition, mutual information games, and subjectivocracy. In our protocol, agents of a decentralized network stake capital to answer questions. A random subset of these agents is scored based on a recently invented peer prediction mechanism called Determinant based Mutual Information. This mechanism is dominantly truthful for a constant number of questions and agents, so it can efficiently yield a plausible estimation of correct answers. Controversial answers may incite forks in a native token and history of answers to reflect differing views of reality. Application-specific fork-choice rules may then be used to determine the correct reality. This paper explicates the above protocol and analyzes its robustness and security.

Their protocol was for coming to “accurate” NFT valuations but the premise would be the same. Token holders stake, are shown two random settled markets and have to choose which was was more “accurately” settled, they are then paid for answering and paid more if their answers fell in line with the average. Given that Polymarket disputes are only occurring at about a 2% rate you can imagine that most settled markets you are shown it’ll be relatively a toss up which market a disputer chooses as “more accurately settled”… but as soon as there is one that is wrong it will bubble up extremely quickly.

In fact the ~2021 Upshot One website even showed that their peer prediction protocol could be used for prediction market resolution

After launching $POLY replacing your USDC incentives and bringing dispute resolution in house there are many other interesting things you could add to your tokenomics that will be mentioned in the various other sections.

Turn on the Fees

You are averaging ~$750m-$1.25b in volume a month. That's roughly around $9b in volume a year.

Aevo charges 0.05%/0.08% on perps and 0.25%/-0.1% on pre-launch perps for taker/maker orders.

Kalshi charges fees that scale based on the price of the contract you are buying.

fees = round up(0.07 x C× Px (1-P))

P = the price of a contract in dollars (50 cents is 0.5)

C = the number of contracts being traded

round up = rounds to the next cent

this would be something like 6.4% in fees on a contract trading at 10% scaling down as the price of the contract goes up. The full fee schedule can be found here

Pretty expensive, especially considering most markets are long bets, but not as expensive as sportsbooks take!

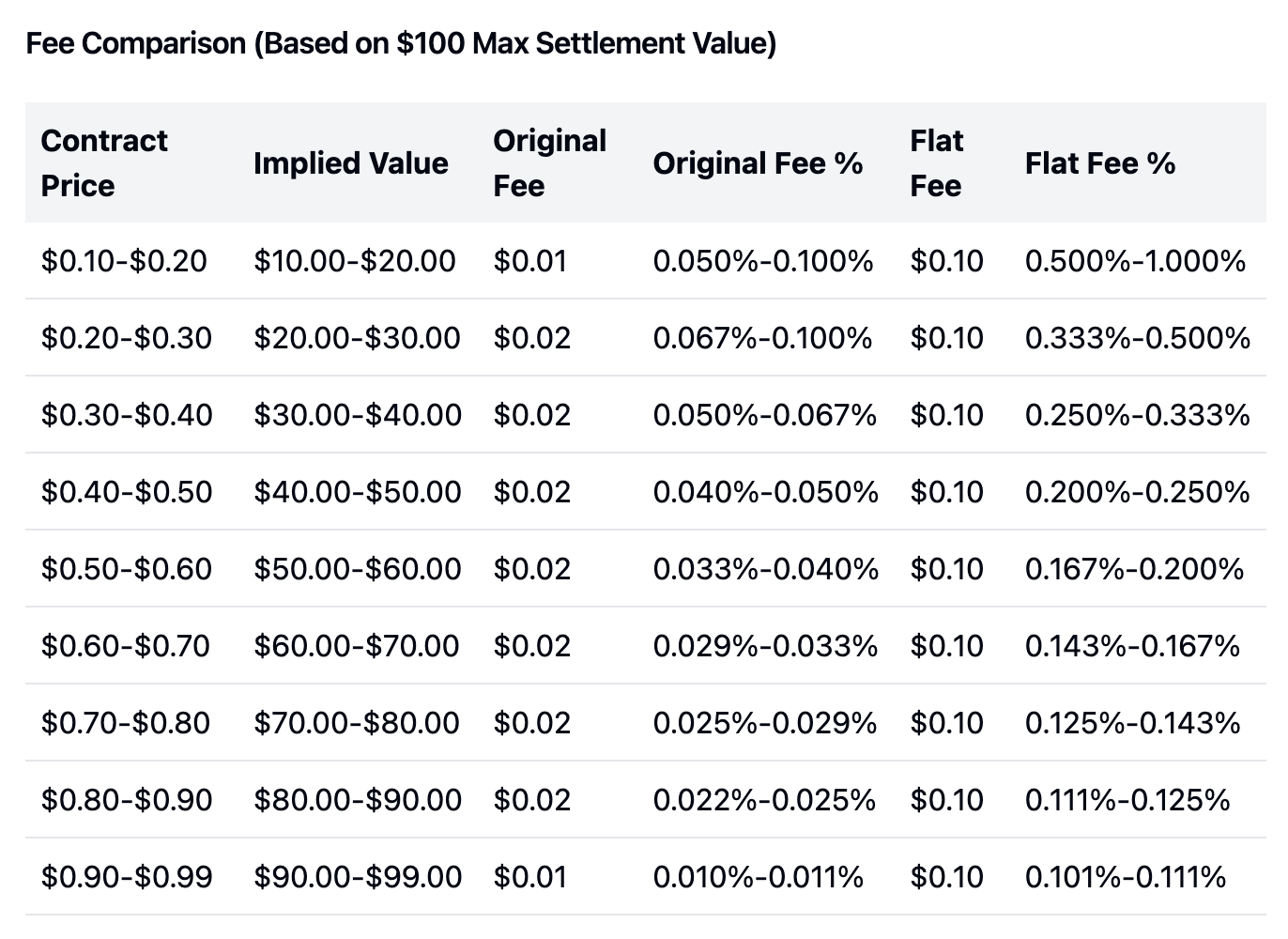

Interactive Brokers ForecastX currently charges zero fees for their markets but $0.1/contract on CME event contracts (their contracts are $100 in size not $1) so their fee schedule looks something like this

much more reasonable then Kalshi’s fees and pretty much in line with Aevo pre-launch future’s fees.

If you were to charge $0.01 per contract on $10b in volume you’d be making about $100m in fees or charging something like the the pre-launch rates (0.25%) on all contracts regardless of price you could make roughly ~$25m. This is a pretty rough estimation as it doesn’t account for different fees for the maker/taker volume split of which you are already incentivizing at extremely high rates.

For the last few years the zero fees have been great for Polymarket’s growth and potentially turning them on could frustrate some users. This seems relatively easy to fix by simply accruing a high percentage of the fees back to token holders (maybe those staked to your dispute resolution platform!). At a $350m FDV $25m in fees would represent about a 14x PF Ratio

Add some yield to your collateral

You have like ~$100m in open interest right on unresolved markets now but it was ~$500m during the election. Kalshi gives users 3.75% interest on cash deposits clipping something like ~0.5% depending on the rates. IBKR ForecastX also pays out interest on deposits but only when you have it in active event contracts. Offering some yield on cash deposits is extremely important for event exchanges as it helps to incentivize longer term markets and have them priced more accurately (there is a discount rate or time value of money applied to the longer term markets that hopefully 3.75% can help pay for).

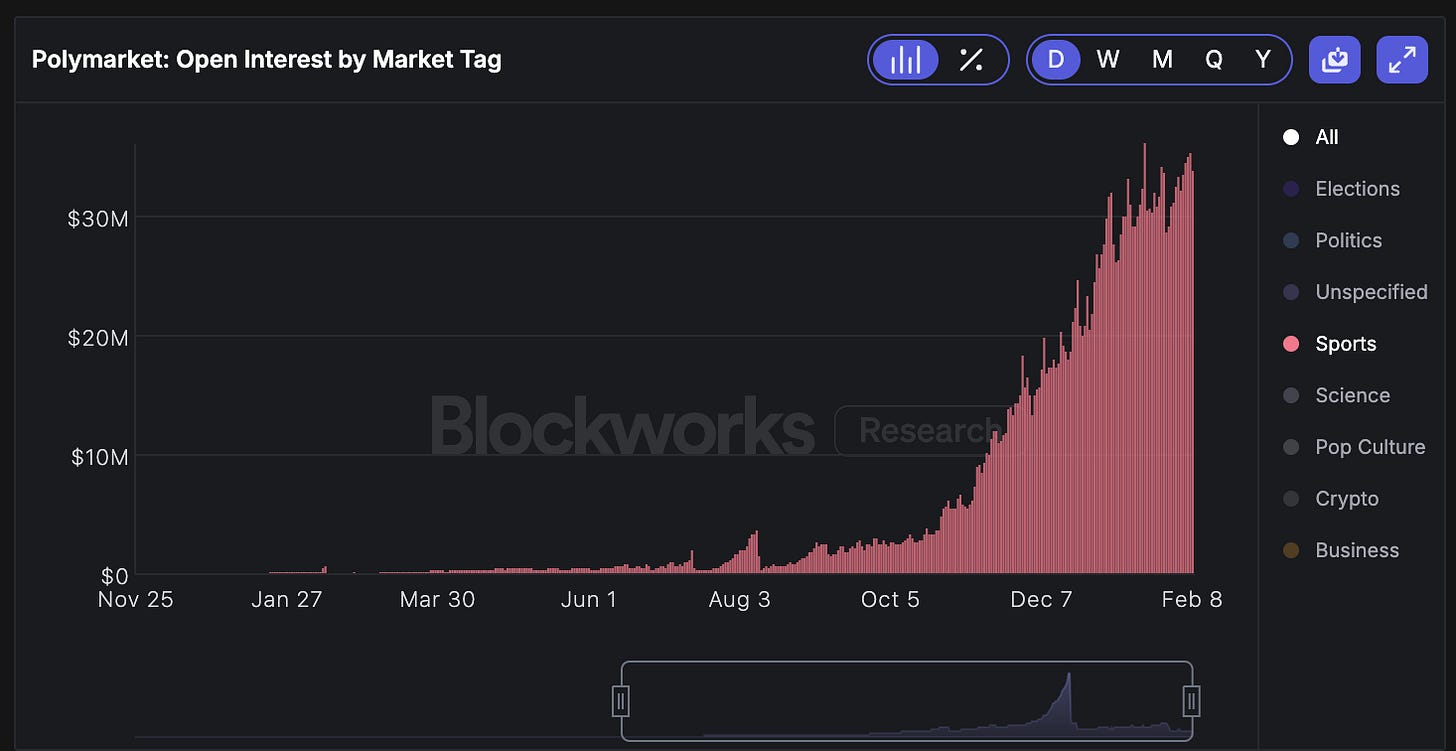

This is actually something that would be extremely helpful to Polymarket as your markets have consistently trended shorter with an average of 21 days and a median of 4 days.

This is potentially most attributed to the large growth of growth sports markets, but is likely also indicative of mention markets and other “will X happen by Friday markets” that are popular on the platform.

Simply replacing USDC as the collateral on the platform with something that is yield bearing like Ethena or the various Ondo offerings. It is likely that you could partner with someone like Ethena to launch your own stablecoin with them in which you keep some percentage of the interest and pass the rest to the user for longer term markets. Alternatively you could just add a new yield bearing stable as collateral alongside regular USDC and show some banners offering current USDC depositors to switch.

Conservatively assuming ~$100m is the average open interest throughout the year (and rates stay about the same, which is seemingly likely throughout June based on your Dashboard) and you did some partnership with a stablecoin provider in which the Polymarket protocol earns ~0.5% on the collateral that would be an roughly ~$0.5m (or ~$2.5m at $500m in open interest).

Add in some Parlays

The growth of sports betting tells us one thing, people love betting on parlays, are bad at it, and the book makes 56%+ of their revenue from it.

Polymarket needs to launch parlays. Right now Polymarket Sports offers straight bets (and it's seen decent volume there!). The exchange sports betting model is becoming pretty popular with Polymarket, Kalshi, Novig, Sporttrade and others all using the exchange model. Outside of Novig very few sports exchanges actually offer parlays. This makes sense it's kinda opposite of what sports exchanges are meant to do (remove the house and focus on offering tight spreads on straight bets).

In the past you have offered conditional markets that are something like this "If the Chiefs win the Super Bowl, Mahomes has 2+ TDs". The interesting thing here is that there are two separate markets here that are linked together into a new market and they all trade on separate order books. Meaning there are 3 markets in total one for each straight bet and one for the parlay. It would be nice to have the liquidity unified (everyone that wants the one of the straight bets and the part of the parlay that matches that straight bet in the same orderbook). In practice this can't really work without a third-party "house" (although if someone has some crazy AMM design that can do this and pair it with an insurance fund, please reach out).

Let’s walk through why you either (1) need a house or (2) a separate orderbook

- Event A is trading at a 10% chance (+900 american odds)

- Event B is trading at a 15% chance (+567 american odds)

- Event A and B parlayed 10% * 15% = 1.5% chance (+6567 american odds)

A user could buy $100 of event A to win $900, they could buy event event B with $100 and win $567 or you could parlay event A and event B for $100 to win $6,567. If this was using pure sports exchanges (no house) and there was no unified book (ie the markets traded separately) there would not be enough to pay out the bet. This is generally where the house steps in.

Novig, a sports exchange launched parlays a few months ago but do so with a third party.

Offering parlays with a separate orderbook in the way that you have in the past (markets like “If this then that”) is not scalable. At any given time you have over 10k+ markets available for trading… thats a lot of potential parlays. Building a more flexible and scalable parlay system would allow me to (1) trade crazy markets like a Trump mention with a LeBron o10.5pts and (2) greatly increase trading activity.

You should launch parlays for big events on their own orderbook as you have been doing and then also launch “custom parlays” which would allow for a user to pair just about any market offered on the platform with any other. This could work with some combination of a insurance fund that potentially $POLY holders could stake into. OkBet has a pretty interesting whitepaper (telegram link) on this but generally the idea is

you have a reserve pool anyone can supply into

outside of constraints like market correlation you can pair just about any markets with each other up to 10 markets to create a parlay

if the payout for that wager is >10% of the reserve it cannot be placed

if the parlay hits the loss is socialized through the reserve fund, else the initial wager is distributed to the reserve stakers

There is a lot more thought that needs to be put into something like this but this would give you a huge profit center and an extremely unique product in offering a huge selection of parlay-able events

Launch a Forecast Index Business

In a Truflation kind of way you could have a really strong forecast index business for Fed Rates, Weather, etc. You can browse their data feeds here.

Metaculus recently launched this with their AGI readiness index (and it seems like they will be launching more forecast indexes) which is pretty cool in that they aggregated a few markets to come up with a single value that AI Safety folks hopefully appreciate.

You already have the start to this with the various election and fed rate dashboards you just need to split them out into individual indexes and list them like data feeds.

The easiest one to the think about is having a forecast index for Fed Rates. As of 2/9/25 the March Fed Rates dashboard looks like this

You could take the average of the ranges and calculate the implied rate based on the probabilities.

This easily displays the forecasted index for the Fed Funds Rate after the March meeting in a very digestible (and tradeable) way. In fact platforms like Kalshi already somewhat display it like this, it’s just you have to trade the individual brackets not the index.

It seems like a relatively low lift to calculate the implied rate across all of your bracket markets which include many financial, economic, and other indicators. As Polymarket becomes the information market it will be important to have easily referenceable future indexes.

You are already cited constantly and used as an index. Build a business around it

OTC / Pro Trading Interface

I don’t even have to be a whale to need to carefully scale into a $10k position on just about any given longer tail market because of the liquidity. Large traders like Domer consistently mention that they trade point and click on the platform, no automation, no advanced charting or order management systems.

Platforms like Aevo used to have OTC interfaces (mostly focused on getting quotes for their option products), Kalshi has quietly rolled out an RFQ endpoint, and long standing platforms like American Civics Exchange are an OTC event contracts exchange and if you briefly browse the Polymarket discord you will see tons of requests to do OTC deals.

I think this could be a relatively low lift, hire a few people and spin up a Telegram channel(s) where traders can get quotes across markets on large sizes and you can help to manage getting in and out of the position. I think that there is also a portfolio construction aspect of this to, some large traders might simply say “I would like to hedge <enter any middle east conflict>” but not bother with reading through tons of different markets, parsing the resolution criteria and finding a set of markets that fit what I want. Seemingly PolyOTC could handle this.

This could also come in the form of simply having a more pro trading interface. It would be pretty nice to have some portfolio management tools, be able to see historical pnl as a chart, be able to view markets with a trading view style chart,etc.

Okay now for somewhat less immediately actionable items that can be worked on in a somewhat longer form roadmap.

Focus more on being "News"

You already have the Oracle and Boring News which are great distributions and plenty of people who regularly pull up the exchange to check the odds and get context to the news they are reading.

You should make your homepage look more like a news site as that is what the large majority of your users are coming for. Simply show latest news articles based on trending markets!

Platforms like Metaculus show News Match on various markets as you can see here. This is a nice way to surface trending news alongside your market odds.

There’s a lot more I think you can do here and many of the concepts of in-context news are what I am trying to tackle at Adjacent News (which will rebooted / have a v2 launch soon!)

New Instruments and Market Types

I was recently browsing Parcl after not following it closely for a while and was very surprised to see that alongside their real estate and rental markets they also now offer markets on housing sale data and various majors like SOL, BTC, ETH.

This is interesting in that the housing sale data perpetual futures are almost exactly something Polymarket could have if they created an index out of various housing indicator markets (which you don’t have but should, Kalshi has them).

It was also interesting to see Parcl expand into regular perp markets, I think this is a nice way to round out their offerings. For Polymarket offering markets like these would round you out as the everything exchange but also present interesting trades all within your platform. For example there are plenty of MicroStrategy (now just strategy.com) BTC purchase markets or markets about the Bitcoin Reserve. You could pretty easily put together some pair trades across the perp and event markets.

As mentioned in the forecast index section the next step after having indexes on implied probabilities of your economics bracket markets is to launch markets on those indexes.

Lets go back to the Fed Rate market from above. The implied rate rate after the March meeting is 4.31% using that and applying the same methodology (calculating the implied rate on the midpoint of the various brackets) we end up with

May:

June:

From there you can get a nice forecast index chart of what the Fed Funds rate looks like in the future based on the implied probabilities of the bracket markets.

Right now these markets need to fit into the bracket type so that they still work within the Gnosis Conditional Token Framework. Potentially expanding the exchange to support dated and perpetual futures could be extremely interesting as you could take your (potential) Index Business and offer markets directly on them. In this case there could be dated futures for each March, May, and June Fed Funds Rate along with a perpetual future market that would represent the current rate.

Regardless if you expand into other instruments like dated and perpetual futures to offer products like these you could still license out your Indexes for other futures exchanges to launch products on.

As Ondo brings tokenized equities on-chain you could also list these which of course would present interesting pair trades with various markets

User Created Markets

This seems like this is something that everyone wants but pretty much only exists in Manifold or alternatives like PlayMoney which are great for many reasons but still no one falls into the “permissionless market creation and real money trading” prediction market camp (If you are building this shoot me a DM!).

Right now Polymarket has creator markets which are nice because they preserve the overall quality of their markets. (You don't want to have tons of "will I go to the gym" markets that are all over Manifold) But are still limiting in that I cannot go to Polymarket with a question I might have, launch a market, and in a short period of get a good general forecast.

I’m not entirely sure the best solution here because simply turning on permissionless market creation would severely degrade the quality of markets on Polymarket. I do like the current creator market setup but would maybe add in a form or something so people can apply to create.

An extremely interesting alternative (that I am not entirely sure is a good idea) is a pump.fun derivative Polymarket Launchpad. This would simply be

Permissionless market creation user locks a certain amount of initial liquidity, market is launched

When the market has reached a certain volume it graduates, the user gets their initial liquidity back and the market is listed on the primary Polymarket website

This allows for anyone to create a market, creates a nice expansion on your creator market program that can highlight really good market creators, is a great way to scale your market creation to make sure you are listing what’s hot in the news cycle right now (rather than having your listing interns be 24/7 online), preserves the quality of your markets on the main site, and is likely another great way to generate fees (see pump.fun fees).

Private Company Indexes

The last few years tons of companies have tried many different ways of wrapping private companies into something that can be easily tradable like an ETF. Public equities are somewhat likely going to be tokenized and listed on CeFi exchanges (like Ondo), which maybe then leads into private companies valuations being tokenized as well.

Prediction markets are great for this you can simply have bracket markets on the next expected valuation of the company. For example here is a market for Kalshi that I created.

You don’t have to spend a lot of time on our part of Twitter before you see people expressing interest in shorting the latest vaporware startup or wanting to get into private rounds for companies they really believe in. Offering private company bracket valuation markets seems like a pretty easy and effective way to do this.

Even better than bracket markets, and once again nicely paired with the proposed Index business, you can create an index for a given private companies valuation which can then freely trade as a long dated future on their next funding round.

I think of this as a crunchbase on steroids, I get market distilled information on the value of a private company and I can participate in the market if I would like.

Here are some other little things that would be nice!

Unify your APIs or at least deprecate / move to legacy some of them. There's 2 documented (CLOB and Gamma) and one that's undocumented. Just let me get everything from a single API!

Dashboards should have the ability to be user created. User created content has network effects. It also seems useful that I can put together a set of markets on an issue and share it out with friends

Expand your mobile app into all markets not just the 2024 election. This kinda relates to the point above about being more news focused. Also incorporate dashboards into the mobile app

Thanks for reading hopefully a few of these are actually incorporated!

all very cool ideas! though i would think that an advantage of crypto is that there are open AIs which anyone can build more advanced UIs for. it probably makes more sense for someone else to make the bloomberg terminal equivalent for polymarket

Dumb ideas, you are likely dumb too.