Exploring Kalshi's Exchange Halt

on april 29th Kalshi unexpectedly halted their exchange for an hour

Kalshi halted their exchange a 1p ET on April 29th 2025 and resumed trading at 2:05p ET that same day.

This was unexpected and unannounced and I wanted to know if anything weird happened right before or right after the halt. Did anyone significantly loose money on any daily financial markets that were expiring within a few hours, what about mention markets with speeches about to start?

The entire observable notebook where this is explored can be found at observablehq.com/@adjacent/kalshi-exchange-halt where you can fork and play around with specific markets during the halt time.

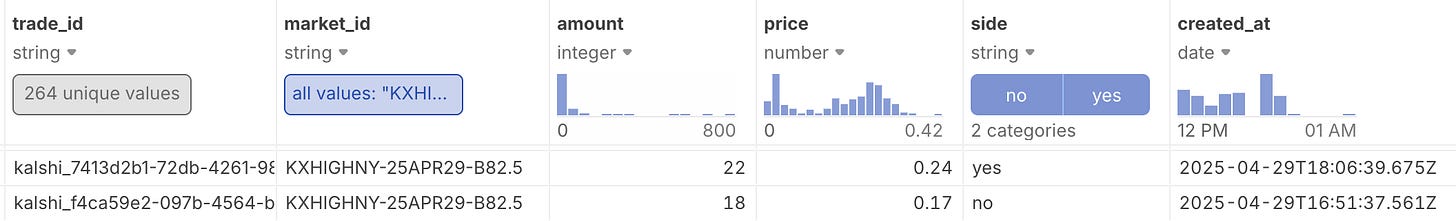

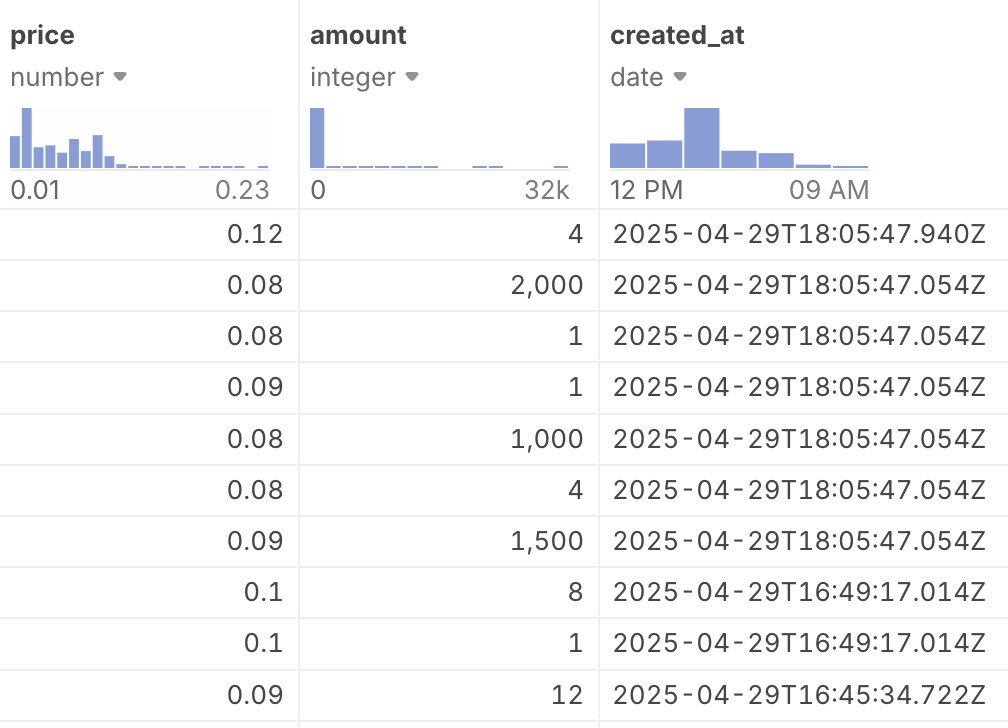

First we get data between 2025-04-29T16:52:00Z (10min before halt) and 2025-04-29T18:10:00Z (5min after halt)

Now we order them by largest % change in price from trades before the halt and after

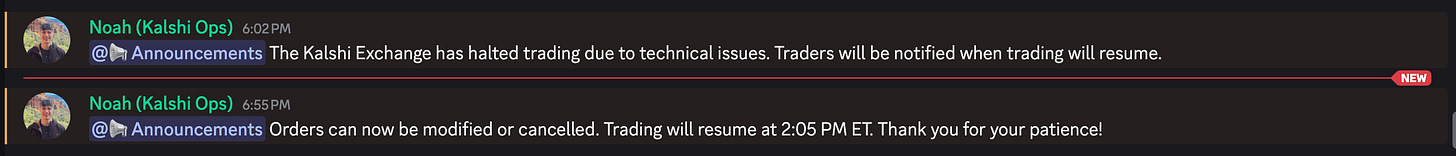

Luckily various daily financial indicator markets like KXBTCD-25APR2913-T95249.99 closed just a few minutes before the exchange was paused at 1p EDT.

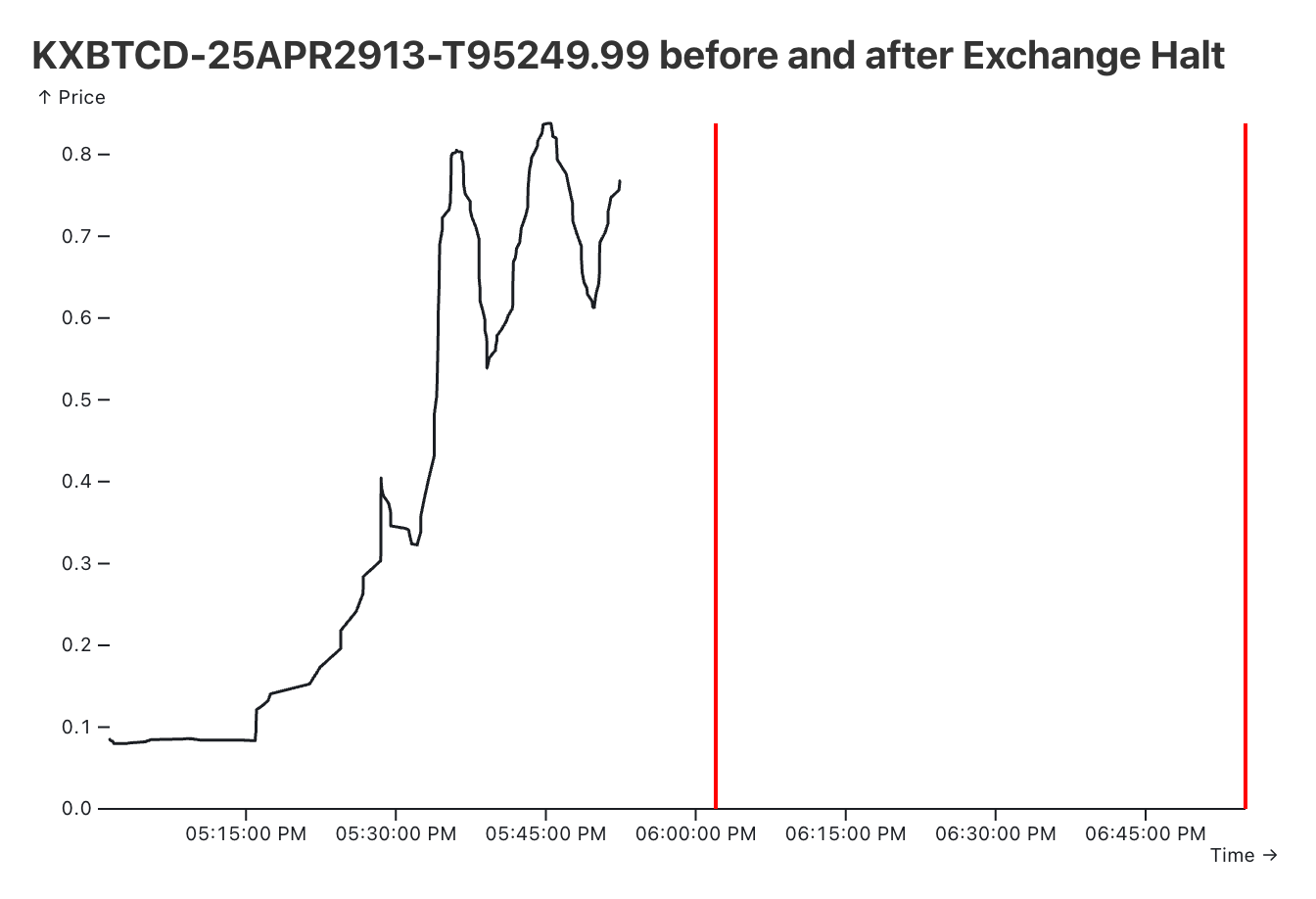

This was pretty much the same thing for the KXNASDAQ100U-25APR29H1300-T19449.9

these markets can mostly be stripped out from the analysis as the markets trading before and after the halt are more interesting.

There are however financial markets that don’t resolve until the market close at 4pm EDT like KXINX-25APR29H1600-B5637, although there were only 2 small trades on it and it this specific strike was trading at a very low price with barely no volume.

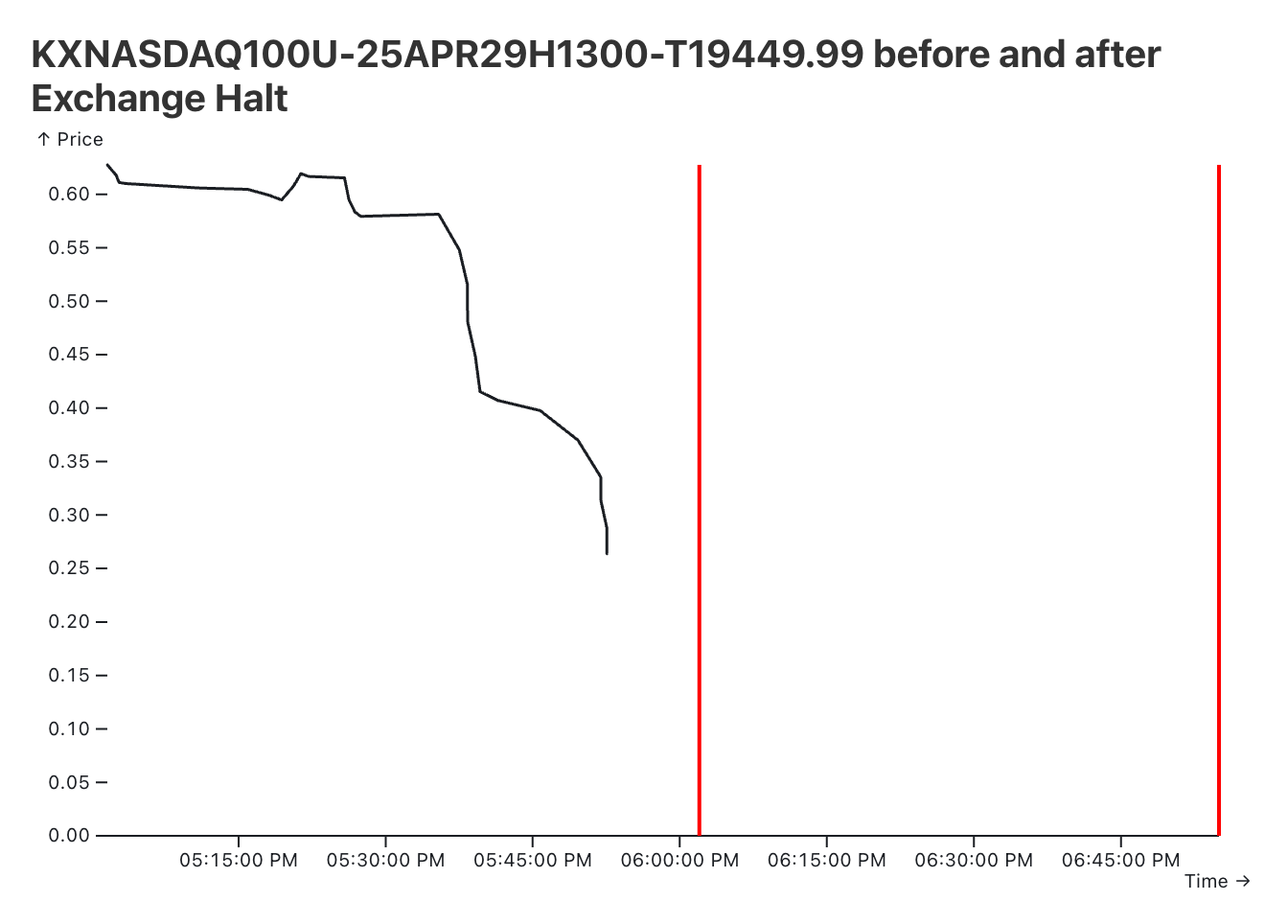

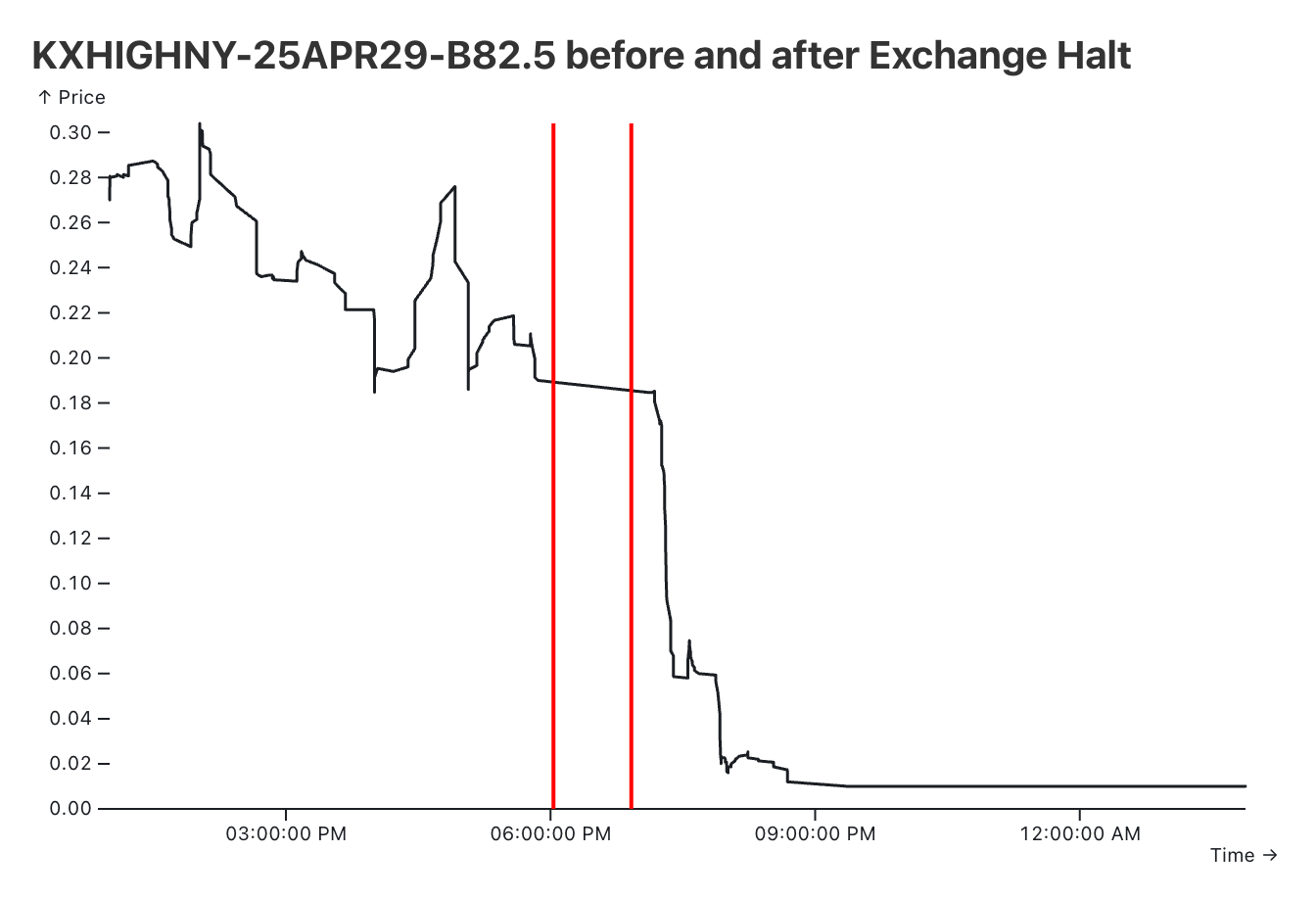

KXHIGHNY-25APR29-B82.5, the daily NY high temperature market was one of the few markets that had a significant jump in price (~40%) within 1min of the exchange restarting. Although it was only with $22…

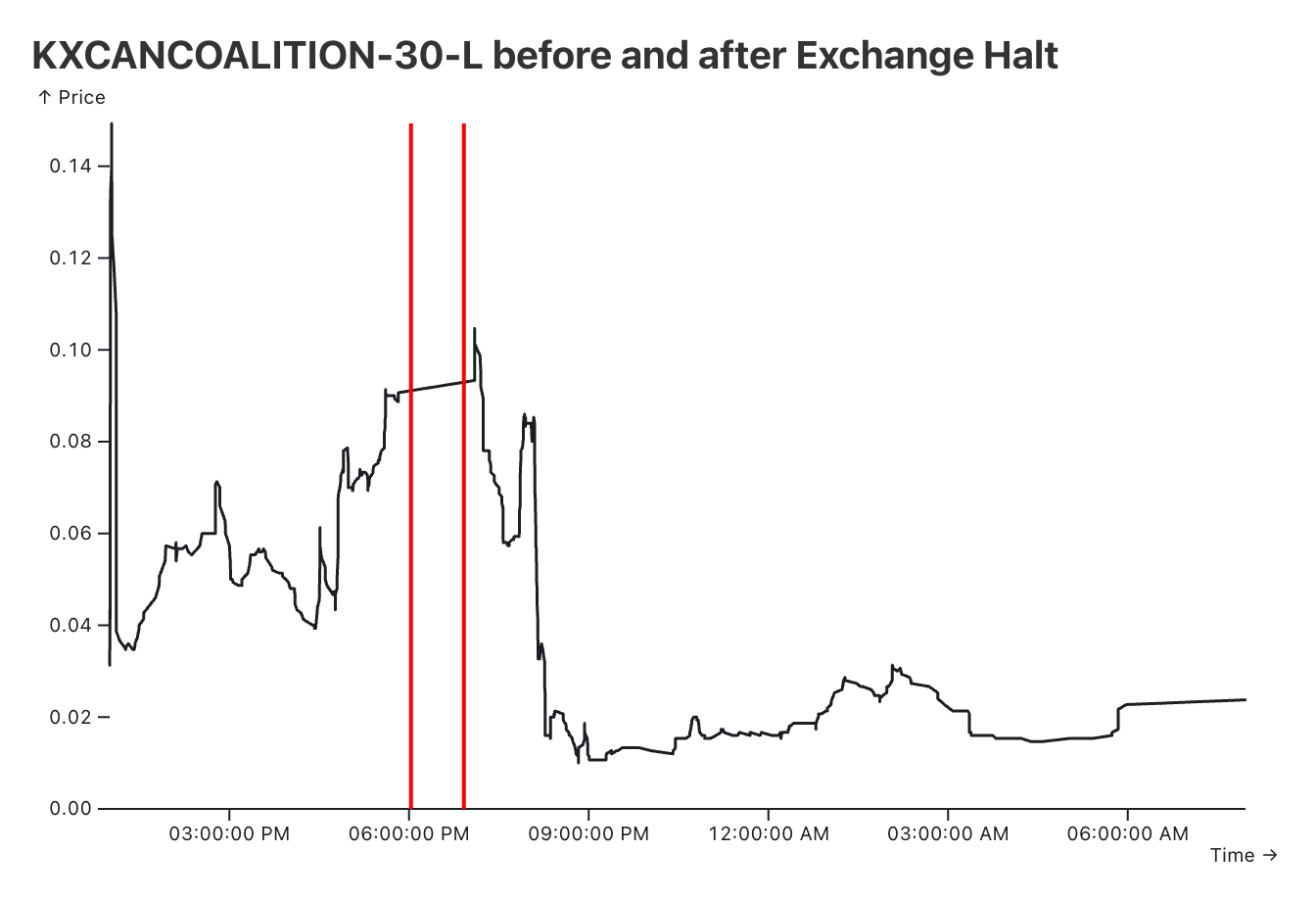

Perhaps out of all the markets analyzed KXCANCOALITION-30-L is the most interesting, with someone strongly bidding up the price post exchange restart

all to quickly be reversed 10min after the restart

Overall not much really happened due to the exchange halt, most markets continued to trade inline, some dailys resolving right before or shortly after where a little funky but for the most part the markets that were traded on right before and after have extremely low volume. Either way this notebook will serve as a good tool incase the exchange halts again during larger trading events.

If you are interested in exploring prediction market data in a more data driven way, hit me up at lucas@adj.news!