Another Kalshi Exchange Halt

and the US-Iran Nuclear Deal Likelihood Index

Kalshi halted once again, which chopped up some of the pope related markets. You can explore the halt with this notebook https://observablehq.com/@adjacent/kalshi-exchange-halt-pope.

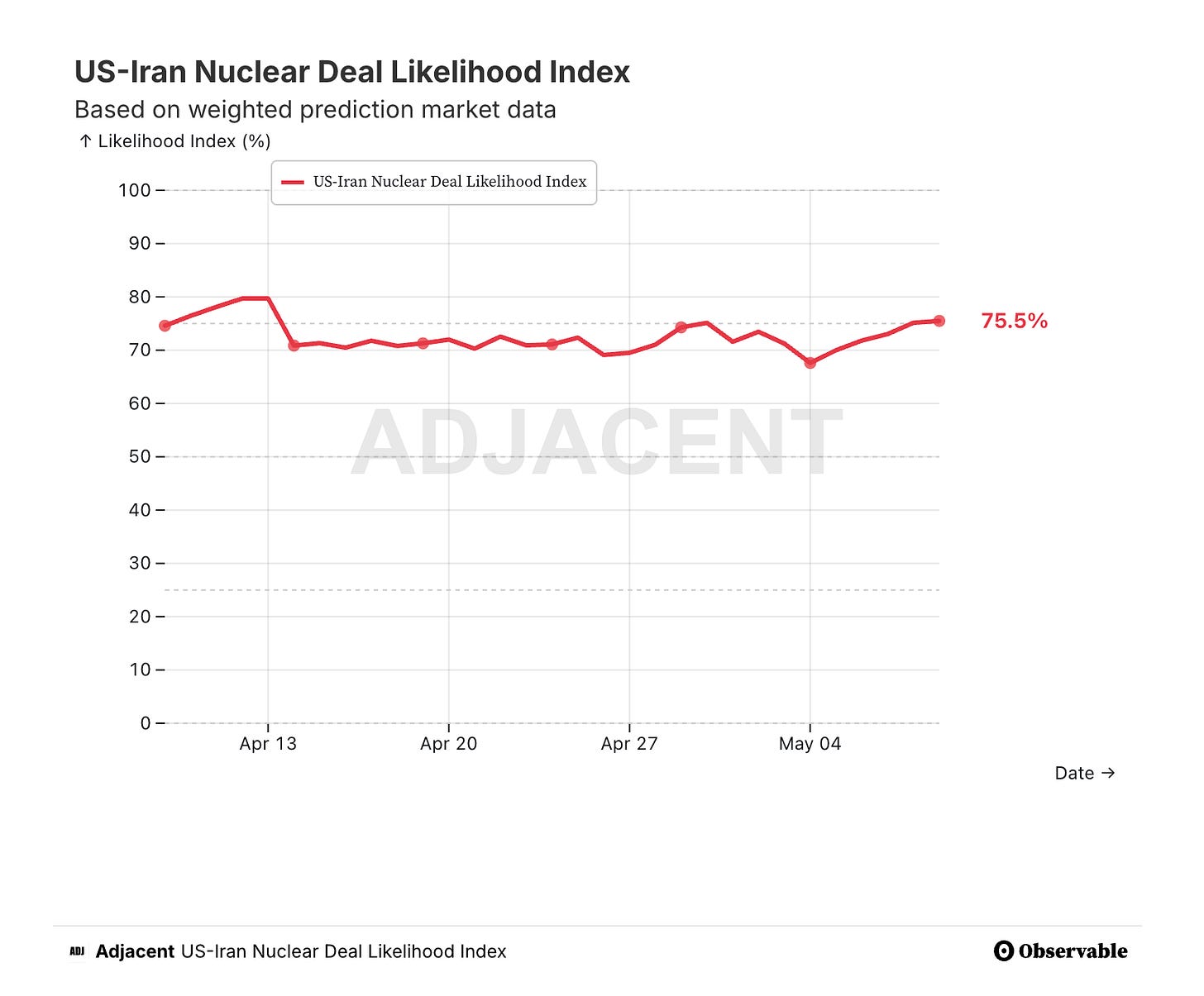

We are also publishing data driven newsletters at adj.news 2-3x per week. Here is a snippet from the latest “Likelihood of US-Iran Nuclear Deal?”

Markets Overview

US-Iran Nuclear Deal Likelihood Index hits 73.9%

Low odds of Iran enriching uranium to weapons grade threshold, trading at 2% and US and Israel military actions trading lower at 12% and 20% respectively, signaling cautious optimism for a deal.

“U.S. enacts AI safety bill in 2025?” market hits 18.2% with $11,602 volume, driven by Senate hearings and a White House AI risk report.

Potential AI safety bill could impose billions in compliance costs on tech giants, influencing innovation and global regulatory standards.

Likelihood of US-Iran Nuclear Deal?: This week, we turn our focus to the likelihood of the US and Iran getting a nuclear deal done. Our newly launched US-Iran Nuclear Deal Likelihood Index stands at 73.9%, offering a weighted snapshot of the probability of a nuclear deal materializing amidst a complex web of geopolitical and military dynamics.

This index aggregates prediction market data across several key markets—"US-Iran nuclear deal before July?" at 34.5%, "US-Iran nuclear deal in 2025?" at 58.9%, "Will Iran enrich uranium to 90% before June?" NO is trading at 97.7%. Similarly unlikely events including, "Iran Nuke in 2025?" NO is trading at 91%, NO "US military action against Iran before July?" is trading at 88% and NO US military action against Iran before July? At 88% and NO “Israel military action against Iran before July?” trading at 80%. These markets, weighted by time horizon, impact severity, and market liquidity, provide a dynamic lens into the likelihood of diplomatic breakthroughs or escalations.